Good tidings for MSE-listed firms

Malawi Stock Exchange (MSE)-listed firms are poised for a good start in the first half (H1) of the year, with about half of them expected a jump in profits, published trading statements show.

In compliance with the listing requirements of the 16-counter MSE, a listed company is required to publish a trading statement as soon as it emerges that there is reasonable degree of certainty that the financial statements will differ by at least 20 percent from the previous corresponding period.

Published trading statements from FMB Capital Holdings (FMBCH) plc, National Investment Trust Limited plc (Nitl), NBS Bank plc, Sunbird Tourism plc, TNM plc and Nico Holdings plc have indicated they expect to post higher profits in the first half of this year.

Nitl plc, whose profit during a similar period last year was K1.5 billion, expects to register a profit of K11.5 billion in the half year ending June 30.

On the other hand, NBS Bank plc projects to double its profit in the period ending June 30 to K10 billion from K5 billion during a similar period last year.

Nico Holdings plc also expects to more than double its profit to between K27 billion and K30 billion in the half-year ended June 30 from K11. 8 billion reported during a similar period last year.

Similarly, profit after-tax for TNM plc, Sunbird Tourism plc and FMBCH, the parent company of First Capital Bank, is expected to increase by 150 percent, 280 percent and 40 percent in that order.

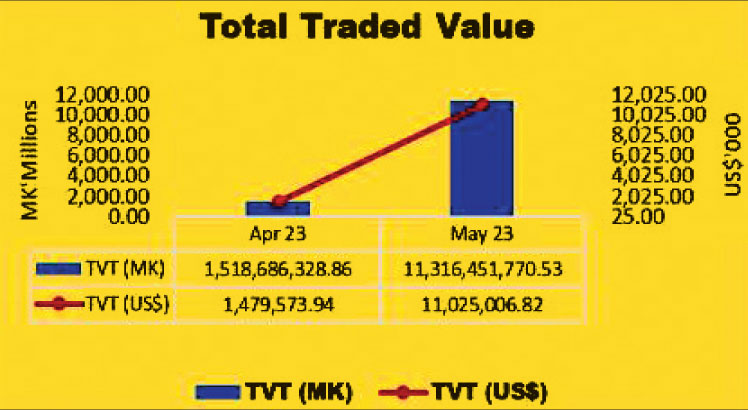

In her explanation, Nitl board chairperson Esther Gondwe said most of its profit is attributed to fair value gains which the firm expects to gain from counters on the MSE.

“We are already in June and the strong performance of our counters will be maintained and contribute to the profit which we are projecting,” she said.

Market analyst Noel Kadzakumanja, who is also Stockbrokers Malawi Limited chief executive officer, said in interview yesterday that the year has, so far, been characterised by some level of excitement and resilience.

He said: “While the situation is difficult to explain, the year has generally been good for most stocks.

“Going forward, we think some stocks might remain resilient as the next half of the year looks exciting and promising to investors.”

Ironically, economic fundamentals, notably interest rates, inflation rates and exchange rates were depressed during the review period.

During the first five months period to May this year, the inflation rate has sustained an upward trend to the current 29.2 percent as of May, according to National Statistical Office figures.

Minority Shareholders Association of Listed Companies secretary general Frank Harawa in an interview said the market has proved to be an attractive avenue for investors.